3D Modeling Software for Linux

Cash App ATM Withdrawal Limit vs. Bank Withdrawal Limits: What You Need to Know?

Cash App ATM Withdrawal Limit vs. Bank Withdrawal Limits: What You Need to Know?

Cash App puts different types of limits for ATM and bank withdrawals. But how do Cash App ATM withdrawal limit compare with traditional bank ATM withdrawal limit? It is a known fact that these limits on Cash App generally depends on the account verification status. Moreover, there are options available to increase Cash App ATM withdrawal limit. So, let’s begin and learn more about Cash App ATM withdrawal limits; their differences from bank withdrawal limits; and what steps you can take to increase them. What Is the Cash App ATM Withdrawal Limit? The Cash App ATM withdrawal limit refers to the maximum amount you can withdraw from an ATM with your Cash App card. Cash App provides physical debit cards (Cash Cards) linked directly to your Cash App account that allow users to withdraw funds at ATMs that support Visa transactions. However as with other such services, Cash App imposes withdrawal limits that vary based on factors like account verification status and payment type. Generally, the withdrawal limit on Cash App is set $310 per transaction. What are the Cash App ATM Withdrawal Limit: Daily, Weekly, and Monthly? The Cash App ATM limit is divided into several categories such as daily, weekly, and monthly limits which are mentioned below: Daily Cash App ATM Withdrawal Limit: The Cash App daily withdrawal limit refers to the maximum amount you can withdraw from ATMs using your Cash App card in one 24-hour period. For most users with standard Cash App accounts, this daily limit is currently $310. Weekly Cash App ATM Withdrawal Limit: The Cash App weekly ATM withdrawal limit is the maximum amount that can be withdrawn within any seven-day period from an ATM. For verified Cash App accounts this amount is $1,000. This limit resets every seven days so if you exceed it before that point, it will reset itself at that point in time. Monthly Cash App ATM Withdrawal Limit: Keeping in mind the maximum daily withdrawal and weekly limits on Cash App, you could withdraw up to $4,000 during any given 30-day period. What are the Typical Cash App Bank ATM Withdrawal Limit? The Cash App ATM withdrawal limit differ significantly from traditional bank ATM withdrawal limits in several ways. As you see the bank accounts typically feature higher withdrawal limits for Cash App account linked to debit card than Cash App accounts do: Cash App Daily Withdrawal Limit: Most banks allow up to $1,000 daily withdrawals at ATMs depending on account type and bank policies; higher-end accounts or premium services often have higher limits. Weekly or Monthly Withdrawal Limits: Banks may impose weekly or monthly withdrawal limits for ATM withdrawals. However these limits can often be adjusted at customer request. How Much Can You Send and Withdraw on Cash App? Cash App goes beyond ATM withdrawals by offering various ways of sending and withdrawing money. However, you must keep in mind how much money you can send and withdraw on Cash App: With a verified account, you can send up to $7,500 every week in payments to others. There is no limit on the amount of money that can enter your Cash App account. Cash App allows users to transfer funds between bank accounts linked to Cash App. There is an average daily limit for verified accounts of $25,000 for this feature. How to Increase Your Cash App ATM Withdrawal Limit? You need to follow the steps mentioned below to increase Cash App ATM limit: First, open the Cash App on your mobile phone. Click on the Profile icon and verify your Identity For this share your personal details such as your full name, birth date and last four digits of your social security number. Once verification is complete your Cash App daily withdrawal limit increase to $1,000 daily and weekly withdrawal limits can go as high as $7,500. What are the Cash App Withdrawal Limit vs. Bank: Real-World Example? Let's say you have both a Cash App account with an ATM withdrawal limit of $1,000, and a traditional bank account that only permits daily withdrawals of $500. In this scenario, cash App would allow for you to withdraw all $1,200 without exceeding its weekly withdrawal limit of $7,500. Furthermore, the Cash App provides higher withdrawal limits compared to traditional banks depending on your account type and status. FAQ What is the daily Cash App ATM withdrawal limit? Verified accounts typically have a Cash App daily ATM withdrawal limit of $1,000 while unverified ones typically have lower restrictions. How can I increase my Cash App ATM withdrawal limit? Your withdrawal limit on Cash App can be increased by successfully completing the identity verification process within the app. How much can I withdraw from Cash App in a month? Under both Cash App daily and weekly limits combined, you could make withdrawals of up to $4,000 in one month.

What Is the Max Cash App Limit for Sending, Receiving, and Withdrawing?

What Is the Max Cash App Limit for Sending, Receiving, and Withdrawing?

The max Cash App limit for sending, receiving, and withdrawing on your account verification. There are two types of users on Cash App- verified and unverified. Suppose you are an unverified Cash App, then you will be able to send, receive, and withdraw a limited amount of money. And if you complete the identity verification procedure you will have higher transaction limits. For instance, when you set-up a Cash App account and yet not verify identity, you can send $250 and receive $1,000 within a given timeframe. But if you want to surpass these limits, you must get verified on Cash App and link a bank account. After verification, you can send $7,500 per week and receive money without any limits. So, let’s begin and learn more about it. What Is the Maximum Cash App Sending Limit? Cash App sending limit is one of the key elements to take into consideration when signing its services, as it determines how much money you can send. Unverified Cash App users have a limit of $250 daily or $1,000 per month when sending funds. So, if you are non-verified user on Cash App you will only be able to transfer up to this threshold. However, this may not be sufficient for larger transactions. Therefore, you will need to complete the identity verification procedure on Cash App. To do this, you will need your full name, date of birth and last four digits of Social Security Number (SSN). When verified, Cash App's sending limits increase: verified accounts can send up to $7,500 weekly and $30,000 per month. What Is the Maximum Cash App Receiving Limit? Though Cash App gives you the simple option for receiving money, however it does have some restrictions that you should know about. So, if you are unverified Cash App users, your Cash App receiving limit is up to $1000 monthly in payments, which could become problematic if you often receive large payments or use it to conduct business transactions. Once your account has been verified, however, things can be much better. As verified Cash App accounts come equipped with an unlimited receiving limit so that you can safely receive as much money as desired without ever exceeding it. Hence, it is perfect for those receiving regular transfers such as payments for goods and services sold or contributions from friends and family. What Is the Maximum Cash App Withdrawing Limit? Cash App offers several methods for withdrawing money, with each having different limits. Cash App ATM withdrawal limit for unverified uses is set at $1,000 daily, and $1,250 per week. If you want to increase Cash App ATM limit, you complete the identity verification procure. As verified accounts can still withdraw $1000 daily and $1500 weekly via ATMs. However, you have now also had the option to use bank transfers which allow them to withdraw as much as $2,500 at once (instant transfers incur a 1.5% fee while standard ones take between one to three days). How to Increase Your Cash App Limits? If you want to increase Cash App limit, you need to go through the identity verification procedure. To verify your Cash App account, share details such as your full name, birth date and last four digits of your social security number. Once this step has been completed (typically within two business days) additional limits will be put on sending, receiving, or withdrawing cash. In fact, the Cash App's verification process is designed to protect your account from fraud and ensure its security. Moreover, verifying Cash App account not only increases transaction limits but also gives access to other features like directly investing in Bitcoin and stocks through Cash App. Hence it is perfect if you plan to use Cash App regularly or professionally. FAQ What is the send and receive limit on Cash App? Cash App's sending limit for unverified accounts is $250 daily and $1,000 monthly; receiving is limited to that amount as well. Once verified, however, Cash App increases both its receiving limit to unlimited and its sending limit to $7,500 weekly. Can you send $3,000 to someone on Cash App? Yes, you can send $3,000 to someone on Cash App, if you have a verified account. Can I withdraw $7,000 from Cash App? Cash App cards permit withdrawals of up to $1,000 daily or $1,250 weekly. This means you cannot withdraw $7,000 from Cash App.

Step-by-Step Guide to Increase Your Cash App Bitcoin Limit

Step-by-Step Guide to Increase Your Cash App Bitcoin Limit

Cash App is a popular financial app that allows users to buy, sell, send, and withdraw Bitcoin seamlessly. However, understanding the limits associated with these transactions is crucial for maximizing your use of the platform. Below, we’ll break down the daily, weekly, and monthly limits for Bitcoin withdrawals, purchases, and sending on Cash App, along with tips to increase these limits effectively. What is Cash App Bitcoin Limit? Cash App imposes specific limits on Bitcoin-related activities such as withdrawing, purchasing, and sending Bitcoin. These limits vary depending on whether your account is verified or unverified. Verification plays a significant role in increasing these limits, allowing users to handle larger transactions seamlessly. What are the Cash App Daily, Weekly, and Monthly Bitcoin Withdrawal Limits? Cash App users can withdraw Bitcoin, but the limits differ based on account verification: Cash App Daily Bitcoin Withdrawal Limit: The daily Bitcoin withdrawal limit for verified accounts is $2,000 worth of Bitcoin. Cash App Weekly Bitcoin Withdrawal Limit: The weekly limit extends to $5,000 worth of Bitcoin, calculated as a rolling limit over seven days. Unverified Accounts: Unverified accounts typically face stricter limits or may not have access to Bitcoin withdrawal features at all. What is the Cash App Daily, Weekly, and Monthly Bitcoin Purchase Limit? Purchasing Bitcoin on Cash App is straightforward, but the limits vary: Daily Bitcoin Purchase Limit: Verified accounts can purchase up to $10,000 worth of Bitcoin per day. Cash App Weekly Bitcoin Purchase Limit: Weekly limits can go up to $20,000, depending on account activity and verification status. Unverified Accounts: For unverified accounts, the purchase limit is significantly lower, often capped at a few hundred dollars. What is the Cash App Daily, Weekly, and Monthly Bitcoin Sending Limit? Sending Bitcoin to other wallets is another feature offered by Cash App. Verified users enjoys the following limits: Cash App Daily Bitcoin Sending Limit: Users can send up to $2,000 worth of Bitcoin daily. Cash App Weekly Bitcoin Sending Limit: Weekly sending limits are capped at $5,000 worth of Bitcoin. Unverified Accounts: As with other transactions, unverified accounts face much stricter limitations or lack this functionality altogether. How Much Bitcoin Can I Withdraw on Cash App? The exact amount you can withdraw depends on your account’s verification status. For verified users: Cash App Daily Withdrawals: Up to $2,000 worth of Bitcoin. Cash App Weekly Withdrawals: A rolling limit of $5,000 worth of Bitcoin over a seven-day period. If you need to withdraw more, you must plan withdrawals across several days or weeks. How Much Bitcoin Can You Purchase on Cash App? For verified accounts, Cash App allows: Daily Purchases: Up to $10,000 worth of Bitcoin per day. Weekly Purchases: Limits extend to $20,000, based on rolling calculations. This flexibility makes it an ideal platform for users who frequently invest in Bitcoin. What is the Maximum Amount of Bitcoin You Can Send? The maximum Bitcoin you can send on Cash App depends on daily and weekly limits: Cash App Daily Sending Limit: Up to $2,000 worth of Bitcoin. Cash App Weekly Sending Limit: Capped at $5,000 worth of Bitcoin over seven days. Users aiming to send larger amounts may need to verify their account and adhere to Cash App’s compliance requirements. How to Verify Bitcoin on Cash App to Increase Bitcoin Withdrawal Limit? To unlock higher Bitcoin transaction limits, you need to verify your identity on Cash App. Here’s how: Open the Cash App: Navigate to the home screen and select the Bitcoin option. Provide Personal Information: Input your full name, date of birth, and the last four digits of your Social Security Number (SSN). Submit Documentation: Upload a government-issued photo ID and, in some cases, a selfie for verification. Wait for Approval: Verification may take 24-48 hours. Once approved, you can access higher withdrawal and purchase limits. How to Increase Cash App Bitcoin Withdrawal or Purchase Limit? Increasing your Bitcoin withdrawal or purchase limits involves: Completing Identity Verification: Ensure that your account is fully verified. Enabling Bitcoin Verification: Follow the steps outlined in the previous section to verify your Bitcoin wallet. Maintaining Account Activity: Consistently use your Cash App for transactions to establish a reliable account history. Contacting Support: If you’ve reached the maximum limits and need additional increases, contact Cash App support for assistance. Frequently Asked Questions (FAQs) What are the Bitcoin purchase limits on Cash App? Cash App allows users to buy Bitcoin starting from as little as $1. The maximum amount you can purchase depends on account verification levels and can go up to $100,000 per week. Daily purchase limits might vary based on market conditions and regulatory changes. What are the Bitcoin withdrawal limits on Cash App? The Bitcoin withdrawal limits on Cash App range from a minimum of 0.00001 BTC to a maximum of 2 BTC per 24 hours, depending on the user's level of identity verification. These limits are adjusted periodically based on market conditions and Cash App’s internal policies. How do I increase my Bitcoin purchase limits on Cash App? To increase your Bitcoin purchase limits, you need to enhance your account verification. This typically involves providing additional personal information and possibly linking further financial accounts or undergoing identity verification processes such as submitting a government-issued ID. How do I increase my Bitcoin withdrawal limits on Cash App? Increasing Bitcoin withdrawal limits involves completing all required identity verifications on Cash App. Make sure your account is fully verified, which includes providing your name, date of birth, and other requested information along with any necessary documentation. Are there fees associated with Bitcoin transactions on Cash App? Cash App charges a service fee for each transaction when buying or selling Bitcoin, which varies based on market conditions. Additionally, a block chain network fee also applies when transferring Bitcoin to external wallets, which varies depending on the network congestion. How long does it take to withdraw Bitcoin from Cash App? Withdrawals to external Bitcoin wallets typically take 30-40 minutes but can vary depending on the congestion of the Bitcoin network at the time of your transaction. Can I withdraw Bitcoin to any wallet from Cash App? Yes, you can withdraw Bitcoin to any Bitcoin wallet that supports external transfers. Ensure that the wallet address is correctly entered to avoid losing your funds. Is there a limit to the number of Bitcoin transactions I can make daily on Cash App? While there is no set limit on the number of transactions, the total amount of Bitcoin bought or sold cannot exceed the daily and weekly limits imposed by Cash App. What should I do if my Bitcoin transaction is delayed on Cash App? Bitcoin transactions can be delayed due to high network congestion or issues with Cash App’s service. Check the transaction status in your Cash App activity feed. If it has been several hours and the transaction still hasn’t processed, contact Cash App support for assistance. Are my Bitcoin holdings insured on Cash App? – Bitcoin investments through Cash App are not covered by the Federal Deposit Insurance Corporation (FDIC) or Securities Investor Protection Corporation (SIPC). It's essential to consider this lack of insurance when investing in cryptocurrencies through Cash App. Conclusion Effectively managing your Cash App Bitcoin withdrawal limits is key to optimizing your cryptocurrency transactions. By understanding these limits and taking the necessary steps to increase them, you can ensure seamless access to your Bitcoin whenever you need it. Whether you're a seasoned crypto investor or new to the world of Bitcoin, following this guide will help you make the most of your Cash App experience.

How to Work Around the Daily Cash App Limit Without Breaking the Rules?

How to Work Around the Daily Cash App Limit Without Breaking the Rules?

Cash App is one of the most widely-used mobile payment platforms, enabling users to safely send and receive money securely. In fact, Cash App gives its users an enjoyable experience when sending funds, paying services bills or making purchases, its interface making the whole experience simple ye effective. However, there is one issue which a lot of users often remain confused about that is the Cash App limit. Yes, Cash App has limits on how much money you can withdraw, send, or receive in each day. So, let’s begin and learn about how Cash App limits work, why they exist and how you can get around them without breaking any laws or rules. What Is the Daily Cash App Limit? Cash App limit represents the maximum amount that you can send or withdraw in 24 hours. These amounts may differ depending on whether your Cash App account has been verified. For instance, your Cash App daily limit could be lower if you do not verify your identity. For sending money it is $250 for a week. Once your identity has been confirmed, however, your limits will increase accordingly. After verification the Cash App limit for a week increases up to $7,500. Why Does Cash App Have a Daily Limit? The Cash App has set daily limits for various reasons which are mentioned below: Cash App reduces the risk of fraud by setting daily limits for how much money can be sent or received in any given period. Cash App must comply with financial regulations, including anti-money laundering (AML) laws and Know Your Customer (KYC). Moreover, the Cash App is protected by a secure network that ensures its integrity and safety for all its users, helping prevent abuse or misuse. Limits have also been set to ensure optimal use. Cash App Daily Limits Explained: Sending, Receiving, and Withdrawing The Cash App limits are divided into several categories such as sending, receiving and withdrawal which are mentioned below: Sending Money: Your Cash App daily sending limit without verifying your ID is $250, meaning that you can purchase or send up to that amount each day via Bitcoin, wire transfer or bank transfers. Once your identity has been verified, the daily limit for sending money increases to $7500. Receiving Money: There is a Cash App monthly limit of $1,000 for receiving money with an unverified account. After passing an identity verification process, you can receive up to $25,000 each month after passing it. Withdrawing Money: Cash App has limits for ATM withdrawals and bank transfers. The Cash App ATM withdrawal limit typically stands at $310 per transaction while your bank's transfer policy determines your limit. For instance, when withdrawing funds using standard methods it would correspond with what can be sent after verification. How to Increase Your Cash App Daily Limit the Legit Way You can increase Cash App daily limit by verifying identity. Here is how to do it in a legit way, simply submit the necessary personal details such as: Your Full Name, Date of Birth and Social Security Number are in this order: the last four digits being your SSN (Social Security Number). An image of any government-issued ID such as a driver's license, state ID card or passport. Verifying your identity allows you to increase the daily sending and receiving limits from $250 per day up to $7,500 and $25,000 respectively for sending per month and monthly. FAQ What is the daily sending limit on Cash App? Cash App has a daily sending limit of $250 without verification, increasing to $7,500 after passing identity verification. How much can I receive on Cash App per day? Without verifying identity, you can receive up to $1,000 monthly on Cash App Can I increase my daily limit on Cash App? Yes, you can increase daily limit on Cash App by verifying your account and reaching out to the Cash App customer support team. What is the Cash App daily ATM withdrawal limit? The maximum daily withdrawal limit from Cash App accounts typically stands at $310. Is there a daily limit on Cash App instant deposits? Cash App sets limits for instant deposits based on your account's verified sending limit, but after verification it allows instant deposits of up to $7,500 daily, less all associated fees and charges. Does Cash App have a daily spending limit? Cash App provides you with a maximum spending limit per transaction. This is often limited by bank regulations. Cash App ATM Withdrawal Limits: A Detailed Guide How to increase Cash App ATM withdrawal limit? Cash App's Daily vs. Weekly ATM Withdrawal Limits: Key Differences ATM Withdrawal Limits on Cash App: What Every User Should Know How Much You Can Send, Receive, and Withdraw on Cash App After Verification? How to Find Out Your Single Transaction Sending Limit on Cash App? Exploring Strategies and Tips to Increase Your Cash App Sending and Receiving Limit Cash App Withdrawal Limit: Here's What You Need to Know? Reaching Number of Transactions Limit on Cash App? What Should I Do for Sending More Money? Why Cash App Wants Me to Verify My Identity When I Haven't Reached My Limits How Much Can I Withdraw, Send, and Receive Daily on Cash App? Cash App ATM Withdrawal Limit Not Enough? Here’s What to Do?

How ID Verification Can Raise Your Cash App Limit from $2,500 to $7,500?

How ID Verification Can Raise Your Cash App Limit from $2,500 to $7,500?

ID verification is an essential part to increasing Cash App limit. And it can help you to get higher sending and receiving limits for your Cash App account. If you use Cash App often and your transactions are substantial, identity verification could be the solution for increasing your Cash App limit. For ID verification, you need to share few required details such as your full name, date of birth, and last four digits of your social security number. After verifying identity on Cash App, you get access to higher sending limits up to $7,500. So, let’s begin and learn about the complete procedure for ID verification. What Is the Daily Cash App Limit? Cash App daily limit depends on whether your account has been verified. Without verification, users are only able to send up to $70 every day. If successful in going through Cash App's identity verification process, these limits can increase significantly. Once your identity has been verified, you will be eligible to send up to $1200 every day on Cash App. Moreover, Cash App users who require quick transfers or receipt of large sums of money now have this capability; verification ensures your account remains protected against fraud. What Is the Weekly Cash App Limit? Cash App weekly limit determines how much you can send in any seven-day period. For example, if you have not verified your Cash App account, you are limited to send $250 each week. Once your identity is verified, however, your weekly sending limit will increase to $7,500. Why Cash App Imposes Limits on Accounts? Cash App imposes limits primarily for the safety and security of your account. The Cash App users these restrictions for several purposes which are mentioned below: Cash App identity verification can make sure that you are the legitimate account holder, thus reducing unauthorised access and fraud risks. Cash App as a digital payment app, hast to comply with certain rules and regulations. For example, anti-money laundering laws. Furthermore, the Cash App provides users with an enhanced user experience by restricting how much money can be transferred or received without first verifying their identity. How to Verify Your Identity on Cash App? If you want to verify your identity on Cash App, you need to take the steps mentioned below: Open the Cash App on your mobile phone. Simply click on the Profile icon Go to Personal, and look for an option called "Verify Your Identity." Click it now. After this share the required details such as your full name, birth date, and last four digits of your social security number. You may need to upload an image of your government issued ID (such as driver’s license, state identification card or passport). Cash App will take some time to review these details and verify your account. How to Check Your Cash App Limits? To check your Cash App limits, simply follow these steps: Open the Cash App on your smartphone. The Profile Icon can be found in the upper-left corner of your home screen. Scroll down and click on "Limits". Here, you can review your sending and receiving limits, as well as any restrictions or other rules applicable to your account. How Do You Increase Your Cash App Limit? Increase Cash App limit simply by verifying your identity. Here is how to do it: Fill out and submit this form with your personal information. Upload an ID issued by the government. Cash App will verify your identity. Once your identity has been successfully verified, you can send and receive up to $25,000 per month and $7,500 weekly. FAQ Is it safe to verify my identity on Cash App? Cash App uses encryption technology to safeguard your personal information, as well as financial regulations for user protection. Can I still use Cash App without verifying my ID? You can use the Cash App without verifying ID. Does Cash App charge a fee to verify my identity? No Cash App does not charge a fee to verify your identity. Can I verify with an ITIN instead of an SSN? Yes, you can use the ITIN instead of an SSN to verify on Cash App. Cash App ATM Withdrawal Limits: A Detailed Guide How to increase Cash App ATM withdrawal limit? Cash App's Daily vs. Weekly ATM Withdrawal Limits: Key Differences ATM Withdrawal Limits on Cash App: What Every User Should Know How Much You Can Send, Receive, and Withdraw on Cash App After Verification? How to Find Out Your Single Transaction Sending Limit on Cash App? Exploring Strategies and Tips to Increase Your Cash App Sending and Receiving Limit Cash App Withdrawal Limit: Here's What You Need to Know? Reaching Number of Transactions Limit on Cash App? What Should I Do for Sending More Money? Why Cash App Wants Me to Verify My Identity When I Haven't Reached My Limits How Much Can I Withdraw, Send, and Receive Daily on Cash App? Cash App ATM Withdrawal Limit Not Enough? Here’s What to Do?

Best trending t shirt design

Best trending t shirt design

Get ready to fuel your creativity with the freshest 2025 t-shirt design trends! Plasticine action T Shirt plasticine action Shirt This year will be about nostalgia, self-expression, boldness, and vibrant colors. Plasticine action T Shirt plasticine action Shirt [url=https://plasticine-action-t-shirt.creator-spring.com/]Plasticine action T Shirt[/url] [url=https://plasticine-action-t-shirt.creator-spring.com/]plasticine action Shirt[/url] As an online seller, you must keep up with the latest design trends and cultural shifts, especially if you want to start a clothing line or expand your custom clothing collection. Aligning your print-on-demand business with new trends helps you meet the needs of your target audience and drive more sales, keeping your products fresh and relevant. [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/plasticine_action_t_shirt.pdf]Plasticine action T Shirt[/url] [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/plasticine_action_t_shirt.pdf]plasticine action Shirt[/url] As an online seller, you must keep up with the latest design trends and cultural shifts, especially if you want to start a clothing line or expand your custom clothing collection. Aligning your print-on-demand business with new trends helps you meet the needs of your target audience and drive more sales, keeping your products fresh and relevant. [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/megan_moroney_merch.pdf]Megan Moroney Merch[/url] [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/megan_moroney_merch.pdf]Megan Moroney Merch shirt[/url] As an online seller, you must keep up with the latest design trends and cultural shifts, especially if you want to start a clothing line or expand your custom clothing collection. Aligning your print-on-demand business with new trends helps you meet the needs of your target audience and drive more sales, keeping your products fresh and relevant. [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/protect_the_dolls_shirt.pdf]Protect the Dolls Shirt[/url] [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/protect_the_dolls_shirt.pdf]Protect the Dolls T Shirt[/url] [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/palestine_action_t-shirt.pdf]Palestine Action T-Shirt[/url] [url=https://www.cucei.udg.mx/maestrias/biotecnologia/sites/default/files/webform/palestine_action_t-shirt.pdf]Palestine Action Shirt[/url] As an online seller, you must keep up with the latest design trends and cultural shifts, especially if you want to start a clothing line or expand your custom clothing collection. Aligning your print-on-demand business with new trends helps you meet the needs of your target audience and drive more sales, keeping your products fresh and relevant. [url=https://palestine-action-t-shirt.creator-spring.com/]Palestine Action T-Shirt[/url] [url=https://palestine-action-t-shirt.creator-spring.com//]Palestine Action Shirt[/url] As an online seller, you must keep up with the latest design trends and cultural shifts, especially if you want to start a clothing line or expand your custom clothing collection. Aligning your print-on-demand business with new trends helps you meet the needs of your target audience and drive more sales, keeping your products fresh and relevant. Megan Moroney Merch Megan Moroney Merch shirt That’s why our design team here at Printful made a list of trending t-shirt designs for 2025. You can refer to our list custom illustrations or promoting bold statements, there’s a t-shirt trend for any taste. Protect the Dolls Shirt Protect the Dolls T Shirt Plus, we’ll give you a few specific t-shirt design ideas for each trend to spark your creativity, along with a free, downloadable pack featuring designs from one of the trends (hint: it’s bound to make you hungry). Let’s dive in! Palestine Action T-Shirt Palestine Action Shirt when you need inspiration to create a new t-shirt design. Whether you’re creating Palestine Action T-Shirt Palestine Action Shirt

Sports betting game development

Sports betting game development

Koinkart is a reputed Sports Betting Game Development Company that offers full services for startups and businesses. We provide custom Sports Betting Software, Prediction Game Development, and solutions using blockchain & AI. Our expert team builds easy-to-use, secure, and scalable betting games to help your business succeed in the fast-growing sports betting market. We Offers Advanced Features Includes: Agile Development Process : Our team follows an agile model to build sports prediction game development projects, which helps to provide fast delivery without difficulties during the process. Reliable 3rd Party Integrations : We connect reliable third-party service providers with our sports betting app development solutions to support your users with smooth operations and trusted tools. Unique Designs : Our design process focuses on compatibility and user focus while applying unique concepts that perform well on all screens for different customers worldwide.

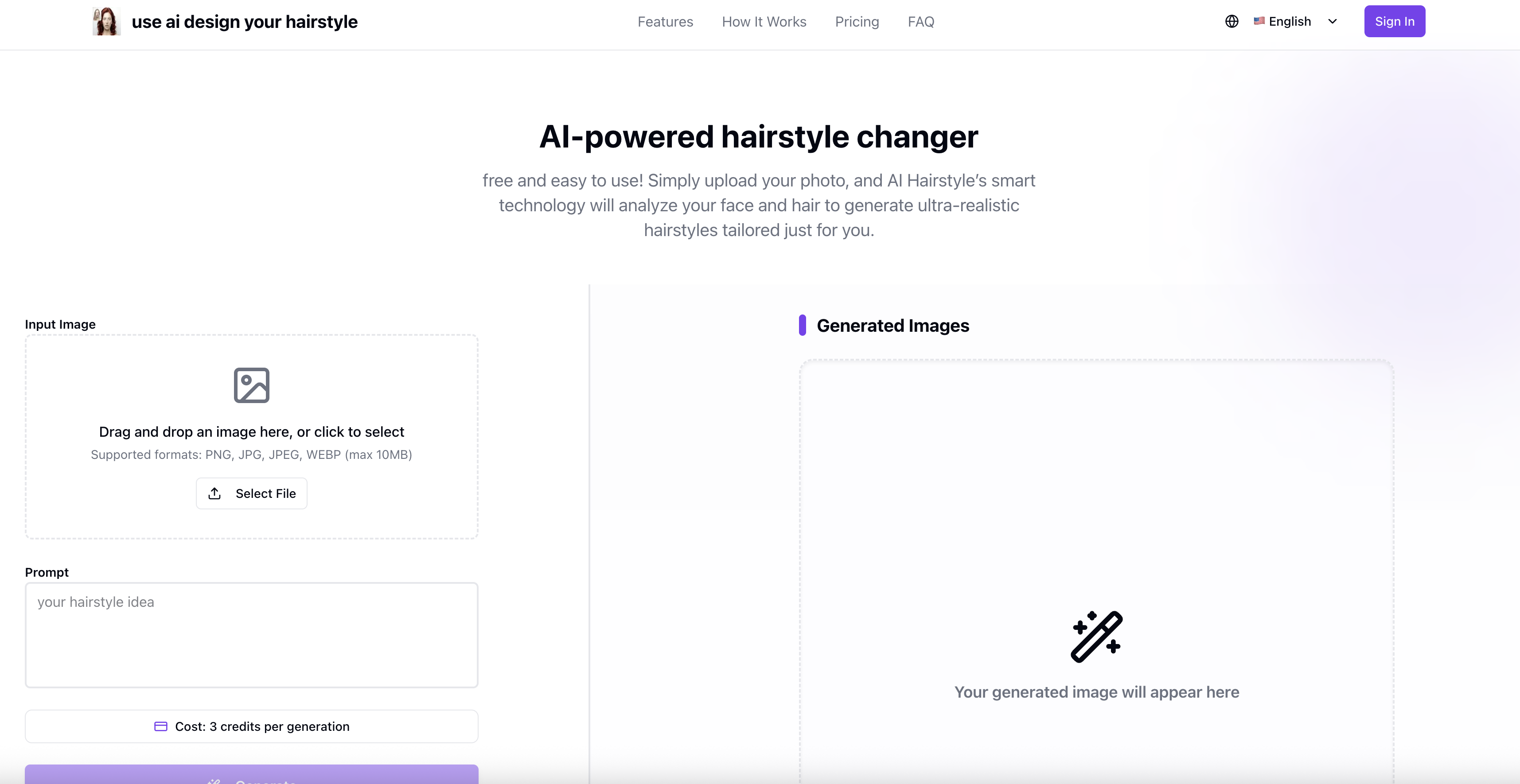

AI-powered hairstyle changer

AI-powered hairstyle changer

Transform your look in seconds with AI Hairstyle Changer. Try 50+ styles and colors for free. No editing skills needed. Start your hair transformation now!https://ai-hairstyle.me/